Workers’ compensation is a system of no-fault insurance that provides medical and monetary benefits to employees or their survivors for work-related injuries, diseases and deaths.

The California Workers’ Compensation Act (WCA) imposes several obligations on employers and includes fines and other penalties for failures to comply. The Division of Workers’ Compensation (DWC) enforces compliance with the WCA throughout the state.

Failure to secure coverage

Employers that are subject to the WCA but fail to secure workers’ compensation coverage for their employees may be subject to a court-imposed fine or charged with a misdemeanor, which is punishable by imprisonment for up to one year in the county jail, or both. Courts can also require an employer to cover the costs of any investigation related to its conviction.

For a first offense, the amount of the fine for an employer’s failure to provide coverage is the greater of: $10,000; or twice the premium a court determines the employer would have paid had it secured adequate coverage.

For a second or subsequent conviction for lack of coverage, the fine increases to the greater of: $50,000; or three times the premium a court determines the employer would have paid had it secured adequate coverage.

Effective Jan. 1, 2013, self-insured employers that allowed their coverage to lapse will be ineligible to self-insure unless they receive authorization from the DWC. These employers may also be subject to a fine equal to 20 percent of outstanding liabilities for the period of lapsed insurance that remain unpaid at the time of their self-insurance application.

Failure to pay compensation

The DWC will use a self-insured employer’s security deposit to pay any obligation the employer fails to provide to an entitled employee. Employers have an obligation to comply with any requests the DWC issues as it audits the employer’s future estimated liability, including replenishing its deposit amount.

The DWC may use deposit funds to pay full compensation, including necessary attorney fees and other costs and expenses. The DWC may also transfer an employer’s security deposit to the Self-Insurers’ Security Fund. The DWC has the authority to resolve any disputes concerning the use, posting, renewal, termination, exoneration or return of any portion of the deposit.

If any employer willfully refuses to pay compensation benefits to an employee, the employee is entitled to receive an additional 10 percent of the benefits he or she is otherwise eligible to receive. An employer that fails to secure compensation as required by law is presumed to have willfully refused to pay benefits.

If an employer’s petition to reduce an award based on a final permanent disability rating is denied, the employer may be required to cover all costs of the petition, including the cost of X-rays, laboratory services, medical reports and medical testimony.

Failure to submit reports/filings

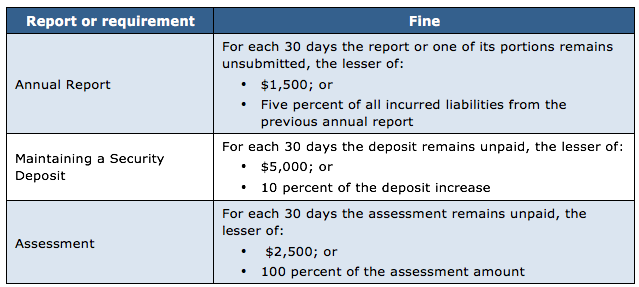

Employers (whether on their own or through a representative, such as an insurance carrier) that fail to submit complete and timely report as required by the DWC are subject to civil penalties. The penalties depends on the type of document the employer fails to submit.

The penalties described above may be modified if aggravating circumstances exist. If an employer that knows or should have known of the obligation fails to comply, the DWC may require the employer to cover all related costs. If the failure was malicious, fraudulent, in bad faith or a repeated violation, the DWC may also award additional damages, up to twice the amount of the fines.

Employers may maintain a security deposit or pay an assessment and reserve their right to challenge the amount of their liability for any given situation. If the employer prevails in a dispute over these payments or deposits, the appeals board will order a release, waiver, compromise, refund or other instruction necessary to remit the amount the employer overpaid or deposited. The DWC may take these measures as well if the violation was the result of mistake, inadvertence, surprise or excusable neglect.

Bad Faith conduct

Employers and employees who engage in bad-faith conduct may be ordered to cover reasonable expenses (including attorney fees and costs) incurred by another party and a fine of up to $2,500. Bad-faith conduct includes actions or tactics that are frivolous or solely intended to cause unnecessary delay. This request must be submitted to the DWC in writing by the party that is seeking the sanctions.

FRAUD

Any person or entity that offers, delivers, receives or accepts a form of consideration for referring individuals to perform or obtain services or benefits they are not entitled to receive is guilty of a crime. Forms of consideration include rebates, refunds, commissions, preferential treatment, patronage, dividends and discounts. This crime is punishable by incarceration for up to one year, a fine of up to $10,000 or both. Subsequent offenses are punishable by incarceration in state prison.

Employers or any other parties that believe a fraudulent claim has been made must report it to the DWC. A good faith report of activities believed to be fraudulent does not expose individuals to defamation, slander or other civil liability as long as the person reporting the apparent fraudulent claim acts in good faith, without malice and believes the action was reasonable.

Fraudulent insurance activities include:

- Willfully misrepresenting any fact to obtain coverage insurance at less than the proper rate;

- Presenting (or causing to be presented) a statement the presenter knows to be false for the purpose of obtaining or denying compensation;

- Knowingly participating or operating in a fraudulent activity; and

- Knowingly assisting, abetting, soliciting or conspiring with a person who engages in an act prohibited by California law.

When assessing an individual’s penalties for fraudulent activity, the courts consider the nature and seriousness of the misconduct, the number of violations, the persistence of the misconduct, the length of time over which the misconduct occurred, the willfulness of the misconduct and the offender’s assets, liabilities and net worth.

CLAIM PAYMENT Enforcement

An injured employee or the employee’s dependents can use attachments to enforce payment of a court-ordered claim. An attachment places an interest or lien on an employer’s property and prevents the employer from disposing of the attached property until the interest is removed. An attachment remains on the employer’s property until the court-ordered compensation is paid in full. Attachments can be initiated at any time after a court issues an order for payment. The court order also fixes the amount of the attachment. Processing of the attachment follows the rules of civil procedure.

For more information, please see the DWC website or contact Nella Insurance Services.

Print this Page | Contact us